HVAC problem solved, ministry future bright

CIF has a framework to help in a way that doesn’t hurt churches … they want churches to stay in a good financial position

Continue ReadingAlong the iconic Route 66, east of Las Vegas, sits Kingman, Arizona, where answered prayers and Christian Investors Financial (CIF) supported a growing Evangelical Free congregation’s building expansion needs.

By 2023, the 11-year-old Journey Church was running about 95 percent full, even with four services on Sundays.

“There we were, sometimes turning people away. We knew we were losing people because they would come in and they couldn’t find a seat,” said Elder Chair Rex Ruge.

Preliminary expansion plans had been made before COVID-19 rolled in, but now they were ready. A new 24,000 square-foot building would be constructed on site to increase sanctuary seating two and a half fold with a much larger common area. Ruge would work closely with CIF, serving as the architect and general contractor for the project.

He said Christian Investors was the preferred lender from the start, based on a great relationship. Journey used CIF for investments and a prior loan refinancing for its first building. But the financial part was just one piece of the puzzle.

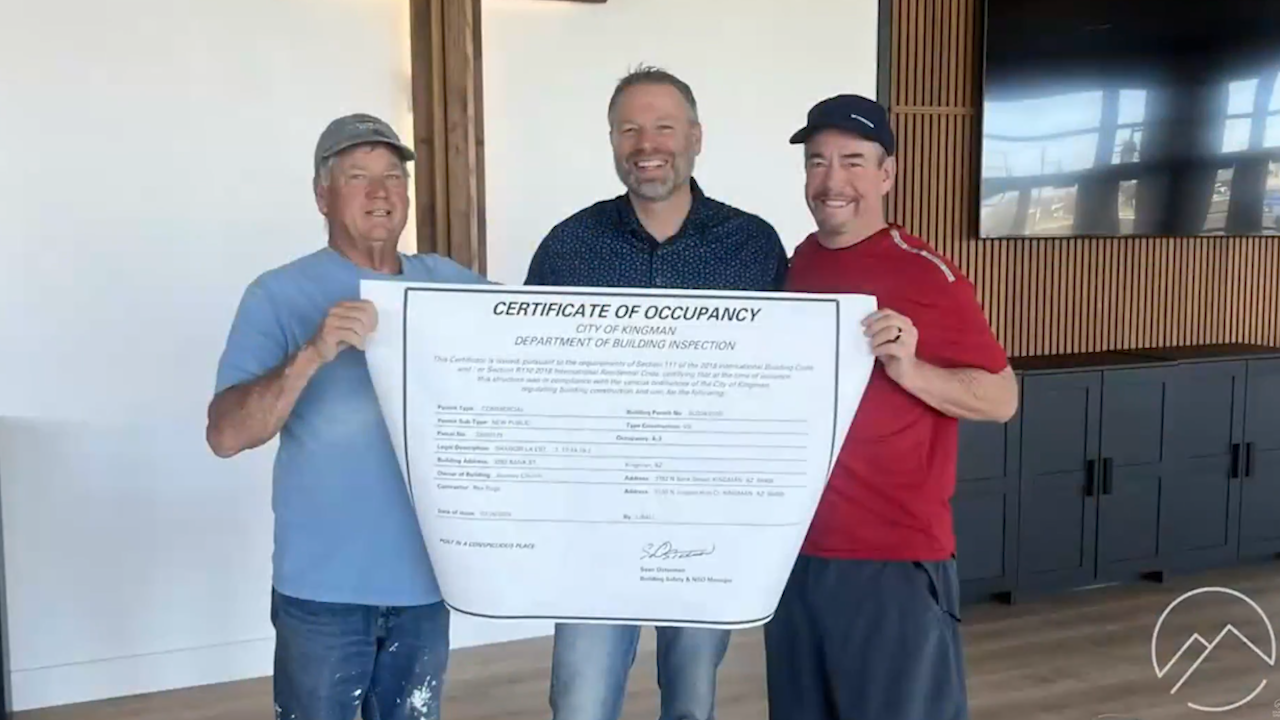

Permit delayed, then issued

The church’s conditional use permit from the city, which would give permission to build, was initially held up for eight months. Ruge designed the church’s first building years prior and had no problems with the city in the past.

After attending a meeting, some changes were made and the church had the use permit in hand within 30 days.

“”You talk about answered prayers? All through this thing, there were times when things would happen and it was just, ‘Oh, okay. I guess that’s not a problem anymore,’” Ruge said.

Pleasant surprise for painting, trusting God during project

Another “God sighting” happened when Ruge met with the painting contractor for the project, who he had not known previously. He knew it would be a significant expense and require a lot of time.

“The first thing he said was, ‘You know, God’s been really good to me. I’m just going to donate all my labor. How about that?’” Journey had the contractor’s full painting crew on the job for six weeks.

Ruge said it seemed that every time he needed a particular skill that he didn’t have or was not familiar with, people would just appear out of nowhere to help. God was blessing their effort.

Two properties, God’s timing

Another answer to prayer involved two houses on an acre each that the church was trying to purchase. Both are near a corner that extends from the church’s property.

“We had nothing but roadblocks,” said Ruge, but the church needed the space. After construction started on the new building, a relative of one of the house owners came and said they were willing to sell for the church’s price. Within 30 days, the church owned the property.

The second house did not come through, but Ruge said this was for the best. If the church had obtained it, street improvements along more than 700 feet of frontage, with curb, gutter, sidewalks and utilities would have been required.

“It would have added hundreds of thousands of dollars to the project if we had gotten that last house, so for now, we don’t have it,” said Ruge.

Generous congregation

Focused on the church’s own “house,” $4.8 million was budgeted for the overall project, including a significant portion covered by campaign contributions.

Journey’s capital campaign to raise funds had been delayed, but once announced by Lead Pastor Matt Larson, half a million dollars flowed in over about four weeks. In all, the church would raise almost $1 million and borrow $3.4 million in two separate loans from CIF.

The CIF Difference on display

Ruge recalled the first building project financed by a bank. It took years to obtain a loan, and the bank required individual cosigners from the church. CIF’s approach was relational, not retail.

Then there were struggles with the other lender over funding draws. “Their requirements were so much tougher,” he said. “It was hard to get money out of them.” Not so with Christian Investors.

The process with CIF could not have been smoother, Ruge said. “It seemed like we put an application (for payment) in and before I even blinked, the money was in the account.” CIF has a thorough but prompt approval procedure to expedite such requests.

Ruge said he has a reputation for paying subcontractors quickly. “You give me a bill, I give you a check. My credibility with subcontractors is extremely high right now, so it’s been great.”

Using the new space, catering to children, families

The common area of the new building is as large as the sanctuary in the old. High end coffee drinks are available and attendees now tend to linger after the service and visit, Ruge explained.

The church has hundreds of children, and there’s something coming for them as well. A half-acre playground is in the works, thanks to a connection made by Journey’s kids and family pastor and an equipment purchase falling through for another church.

Remaining construction funds covered the cost after it was offered for half price, according to Ruge.

A large plaza was also added, with planters, trees and flowers. Grass is growing, which is more difficult to manage in the desert.

“God has been very good at letting me see what He can do,” said Ruge.

More capacity, more outreach

Before the new building, services were running 300 to 350 people at most. Opening Sunday in the new structure saw more than 650 for the first service. For the first time, the church is advertising to better reach the community, because it has the needed space.

Paying off the old, beginning the new

Prior to the new project, Journey set out to pay off an existing loan on its first building. The elders decided the church needed to retire that debt of around $500,000 before taking on any new financing, he explained.

The church was growing exponentially, and offerings were higher than expenses. By the year before the new building began, Journey had reduced the balance to about $100,000.

Moving forward, many people in the congregation continue to play an integral part in these building efforts, Ruge explained. Even with the new payments for the building, and the extra bills it brings, offerings are more than adequate.

“The money has just come, and that’s been a fantastic part of it,” said Ruge. “God just moved right through all these obstacles that we had, and we got it built.”

To learn more about CIF church loans and consulting, we encourage you to explore further on our site.